Frequently Asked Questions

General Questions

What are your office hours?

How do I submit my completed application?

Why can't I view your fillable application?

What can I expect when submitting an application?

What happens once my application has been received?

What are my payment options?

What should I do if I need to report a claim?

How do I resolve a financing issue or question?

How do I request a copy of my insurance documents?

Coverage Questions

What is the difference between Professional Liability Insurance and Errors & Omissions?

Do I need Errors & Omissions coverage?

What is an Admitted vs. Non-Admitted policy?

What are Defense Costs Inside the Limits of Liability vs. Defense Costs Outside the Limits of Liability?

What are A.M. Best's ratings?

What is Prior Acts Coverage?

What is a Retroactive Date?

Why is a Retroactive Date important to maintain?

What is the difference between a Claims-Made policy and an Occurrence policy?

What triggers coverage on a Claims-Made Policy?

What is an Extended Reporting Period (ERP)?

How do I renew my policy?

What happens if my policy is cancelled or non-renewed?

What are Loss Runs?

What is a Subjectivity?

What is a 1031 Exchange Accommodator?

Does my policy cover work that is completed on my behalf by an independent contractor or a temporary employee?

How do I increase my coverage?

How do I add/remove insureds from my policy?

How do I obtain certificates for vendors and others?

How do I cancel my policy?

Why are your Abstractor rates so low?

General Questions

Our staff is available from 7:30 a.m. to 4:30 p.m. Eastern Time to assist you with any questions, concerns or issues you are having.

How do I contact Fox Point?

Phone: (800) 499-7242

Fax: (302) 765-2088

Email: [email protected]

3001 Philadelphia Pike Claymont, DE 19703

How do I submit my completed application?

A unit of trained professionals has been established specifically to meet your needs. We have a variety of ways you can submit your applications. The best way is through email:

[email protected]

Please send all NEW BUSINESS submissions to this address. Our highly-trained staff will distribute/handle each submission automatically. Our underwriters have been cross-trained in all of our classes of business in order to maintain (and even increase) our efficiency!

[email protected]

Please send all RENEWAL applications to this address. Using this address will allow us to quickly process the application and the remaining renewal paperwork.

[email protected]

Please send all MEDICAL BILLING/ALLIED HEALTH submissions to this address.

You can also fax your application to: 302-765-2088

Why can’t I view your fillable application?

If you have issues viewing or submitting the fillable applications on our website, you may need to download Adobe Reader. Visit http://get.adobe.com/reader in order to download it.

What can I expect when submitting an application?

- If your application is received, a confirmation receipt will be emailed to you immediately. Please check your spam or junk folder for this receipt, and if you do not receive it within one business day please call Fox Point to confirm.

- If your application is incomplete, one of our staff will contact you during regular business hours.

What happens once my application has been received?

- Applications that require quoting may take one to five business days. Expedited service may be available. Your quote will be emailed once we receive it from the underwriters.

- Declarations pages and policies are emailed as soon as possible, subject to state requirements/regulations. Expedited service may be available upon request. Coverage is NOT bound until a binder/declarations page is issued.

- Payment in full (by check or credit card)

- Outside financing quotes are available to our direct insureds, with some limitations

- Producing Agents are invoiced for bound accounts

How do I resolve a financing issue or question?

Please refer to your finance agreement for the toll free number of the finance company. You will have to resolve any finance issue directly with the finance company.

How do I request a copy of my insurance documents?

If you are working with an agent/broker, you will need to send your request to them. If you are working with Fox Point Programs directly, please send your request to [email protected]. Requests are usually answered same business day.

What should I do if I need to report a claim?

Information regarding reporting a claim can be found within your policy documentation. Usually it’s shown right on the Declarations Page of your policy. Sometimes the information might be on a separate document that accompanies your policy. If you are unable to locate this information, please contact your insurance provider for assistance.

Coverage Questions

What is the difference between Professional Liability Insurance and Errors & Omissions?

Professional Liability policies are designed to protect professional practitioners against potential negligence claims made by their clients. Professional liability insurance may take on different names depending on the profession. The policies cover certain lawsuits alleging purely economic damages. Such lawsuits occur when the injured party alleges that they have suffered a monetary loss due to failure of the professional (either an individual or a company) to provide services according to generally accepted standards in the industry.

Errors and Omissions (E&O) insurance is a form of professional liability coverage designed to protect an insured against allegations of mistakes made (errors and/or omissions) while performing (for a fee) the duties associated with his/her business. The policy includes coverage for both defense costs (e.g., attorney fees, court costs, etc.) and settlements or judgments. Intentional wrongdoing is specifically excluded.

Do I need Errors & Omissions Coverage?

Professionals engaged in lines of work where they are presumed to have extensive technical knowledge or training and may be held to that standard in a court of law should seriously consider purchasing an E&O policy. In fact, some states and professional organizations require the purchase of E&O in order to be licensed or be affiliated as a member.

The amount of E&O coverage you will need and how much it will cost depends upon the size of your business, the level of coverage you require and your past claim history. As with all types of insurance, the biggest variable in determining the cost of your premium will be the level of risk you pose to your insurer. People who often have claims filed against them will most likely pay larger premiums than lower risk clients.

What is an Admitted vs. Non-Admitted policy?

You may have seen or heard the terms “admitted,” “non-admitted,” “surplus lines” or “excess & surplus.” So, what’s the difference?

An “admitted” policy means that the insurance carrier (insurer) has had to file for approval with each state in which they write insurance. Once approved, they are essentially backed by that state in the event that the insurer was to become insolvent and unable to pay their insured’s claims/legal expenses.

“Non-admitted,” “surplus lines” and “excess & surplus” are all synonyms of each other. These insurers have not had to file with any state and therefore have more flexibility with their insurance rates, coverages, etc. They also do not have the backing of the state, should insolvency occur. This is why it is important to choose a Surplus Lines insurer with a high A.M. Best credit and financial rating. FYI, most professional liability policies are written with a surplus lines company.

For more information regarding the myths of why admitted policies are better, please click here.

What are Defense Costs Inside the Limits of Liability vs. Defense Costs Outside the Limits of Liability?

Defense Costs Inside the Limits of Liability means that in the event of a claim, defense costs incurred would reduce the Limits of Liability shown on the policy declarations page.

Defense Costs Outside the Limits of Liability means that in the event of a claim, defense costs incurred would not reduce the Limits of Liability shown on the policy declarations page, but instead would be taken from a separate additional Limit amount specifically for Defense Costs. Generally, Defense Costs Outside the Limits of Liability would be offered for an additional premium and the amount offered may be restricted based on the underlying Limits of Liability.

Some policies do not offer this option and other carriers may define this differently. It is important to review all options and policy forms with the underwriter prior to purchasing a policy.

For information regarding A.M. Best’s ratings, please click here: http://www.ambest.com/ratings/guide.pdf

Most professional liability claims-made policies offer optional coverage for services performed prior to the effective date of the policy. This is called prior acts coverage. Prior acts coverage is typically extended to the effective date of a firm's first claims-made policy (when claims-made coverage has been maintained continuously) or to some date that your firm and the insurance company agree upon for pricing or underwriting reasons. The date established is called the prior acts date or retroactive date. Generally, the date remains the same with each subsequent renewal. If an act, error or omission happened before the prior acts date, it will not be eligible for coverage. With prior acts coverage, you can move your coverage from one insurance company to another without losing protection for covered services you performed in the past.

Date from which you can show continuous proof of professional liability coverage. There may be NO gaps in coverage--not even 1 day.

Why is a Retroactive Date important to maintain?

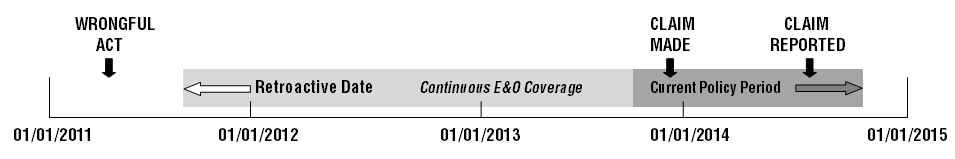

In order for a claim to be covered, it must occur on or after the retroactive date. See Example 1 below.

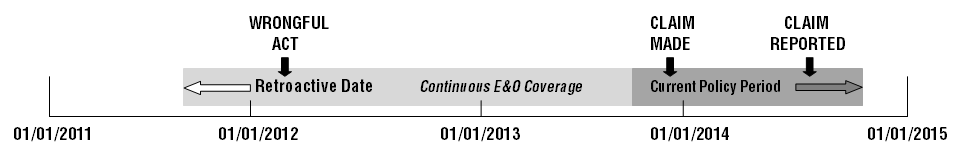

Any claim made prior to the retroactive date, will NOT be covered. See Example 2 below.

Example 1 – CLAIM COVERED

Example 2 – CLAIM NOT COVERED

What is the difference between a Claims-Made policy and an Occurrence policy?

Coverage is activated when a claim is made (claims-made policy) instead of when a wrongful act occurs (occurrence policy).

What triggers coverage on a Claims-Made policy?

- Claim must be made during the policy period.

- Claim must be reported during the policy period*

- The wrongful act must occur on or after the policy retroactive date

* Most policies include an Extended Reporting Period. Check your policy for specific provisions.

What is an Extended Reporting Period (ERP)?

This is a period of time following a policy’s expiration during which the insured can report a claim. Most policies allow for an automatic 30 or 60 day ERP, however there may be additional ERP’s available, depending on the insurance carrier. Please refer to “What happens if my policy is cancelled or non-renewed?” for more information.

Fox Point e-mails renewal applications months in advance, then emails/calls with renewal reminders and applications as your renewal date gets closer. Reduce stress and renew early!

What happens if my policy is cancelled or non-renewed?

Typically, if you cancel your policy before it’s due to expire on its own, the insurance company will return the unused portion of your annual premium, less 10%. The 10% that is not returned is called a “short rate penalty.” If the insurance company cancels your policy, they will return the unused portion of your annual premium with no penalty. This is called a “pro-rata” return.

In the event you are retiring or just closing up your business, you may be able to purchase an Optional Extended Reporting Period. While you technically won’t have insurance coverage, you will be able to report claims that come up after your policy has expired. Many carriers will offer this for 12, 24, 36 months or longer.

Loss runs are documents prepared, usually by insurance carriers, for the purpose of detailing an insured’s claims history. Many carriers will require up to 5 years (and sometimes more) of loss runs before they will consider providing a quote, especially if there has been a claim filed in the past.

Subjectivities (sometimes called Binding Requirements) are items that must be received by the carrier prior to binding coverage. These items can range from a signed specific document, loss runs, payment, etc. These subjectivities will be listed on the quote you receive. Carriers often will not be able to move forward in the process without receipt of these items.

What is a 1031 Exchange Accommodator?

First, let’s explain what a 1031 Exchange is … Section 1031 of the IRS code lets you sell a property and buy a new property without paying any taxes. In order to do this, you must use an accommodator to comply with the rules. The accommodator (also known as a Qualified Intermediary) holds the proceeds from the sale of the relinquished property beyond the actual or constructive receipt of the seller. The accommodator also prepares the necessary documents to accomplish the 1031 exchange.

Does my policy cover work completed on my behalf by an independent contractor or a temporary employee?

For this answer, you will need to consult your policy definitions. Many policies will include an independent contractor in the definition of an insured, but some will not. The same is the case for temporary employees. Therefore, it is very important, especially if you currently employ temporary help or use IC’s, that you ask your insurance provider about how/if they’re covered.

How do I increase my coverage?

On your company letterhead (or with your company name/logo), please state the nature of the change you are requesting and the reason (i.e. you would like to increase your coverage to $500,000/$1,000,000 limit because a client requests a minimum limit of $1,000,000). Email your request to your insurance broker/agent (if you don’t have an broker or agent, send to your Fox Point underwriter). They (or one of our staff) will contact you to assist completing the process after we receive your request.

Please note that a change in coverage is accomplished by endorsement, which is a separate document; a new or substitute Declarations page is not issued by the carrier. Premium limits can be increased seamlessly at renewal.

Some requested changes (limits, deductible, etc.) are not automatic and must be approved by the carrier prior to issuance of an endorsement.

How do I add or remove insureds from my policy?

Email your request to your insurance agent/broker (if you don’t have an agent/broker, send to your Fox Point underwriter). They (or one of our staff) will contact you to assist completing the process after we receive your request.

How do I obtain certificates for vendors and others?

Email your request to your insurance agent/broker (if you don’t have an agent/broker, send to your Fox Point underwriter). They (or one of our staff) will contact you to assist completing the process after we receive your request.

Email your request to your insurance agent/broker (if you don’t have an agent/broker, send to your Fox Point underwriter). They (or one of our staff) will contact you to assist completing the process after we receive your request.

Why are your Abstractor rates so low?

We took a closer look at the title agent industry and noticed that 100% abstractors were being given the same rates as title/escrow agents, even though the exposure for an abstractor was significantly lower. In early 2013, we developed a way to accommodate special rates for 100% abstractors and/or notaries. It has been a huge hit across the country, and we continue to grow in this business segment!